single life annuity vs lump sum

Both options offer retirees. A thinning of an employee base that takes place when a companys benefits plan has insufficient funds to cover the expenses associated with paying.

How Much Income Do Annuities Pay Due

This is not a problem with an annuity because your payments will increase along with the cost of living.

. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. A simplified illustration. Life Insurance You Can Afford.

Ad No Medical Exam-Simple Application. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. A Fixed Annuity May Provide A Very Secure Tax-Deferred Investment.

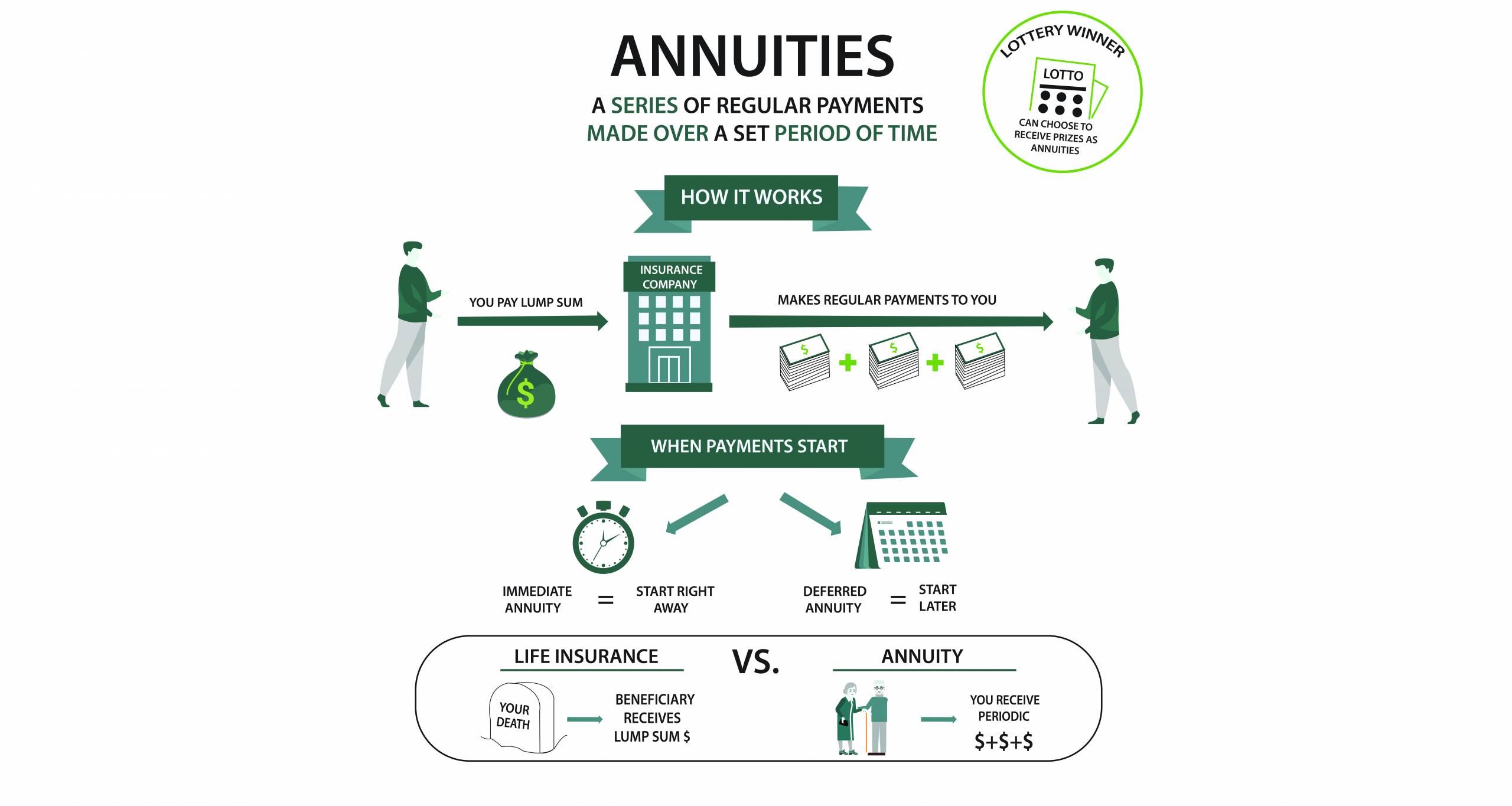

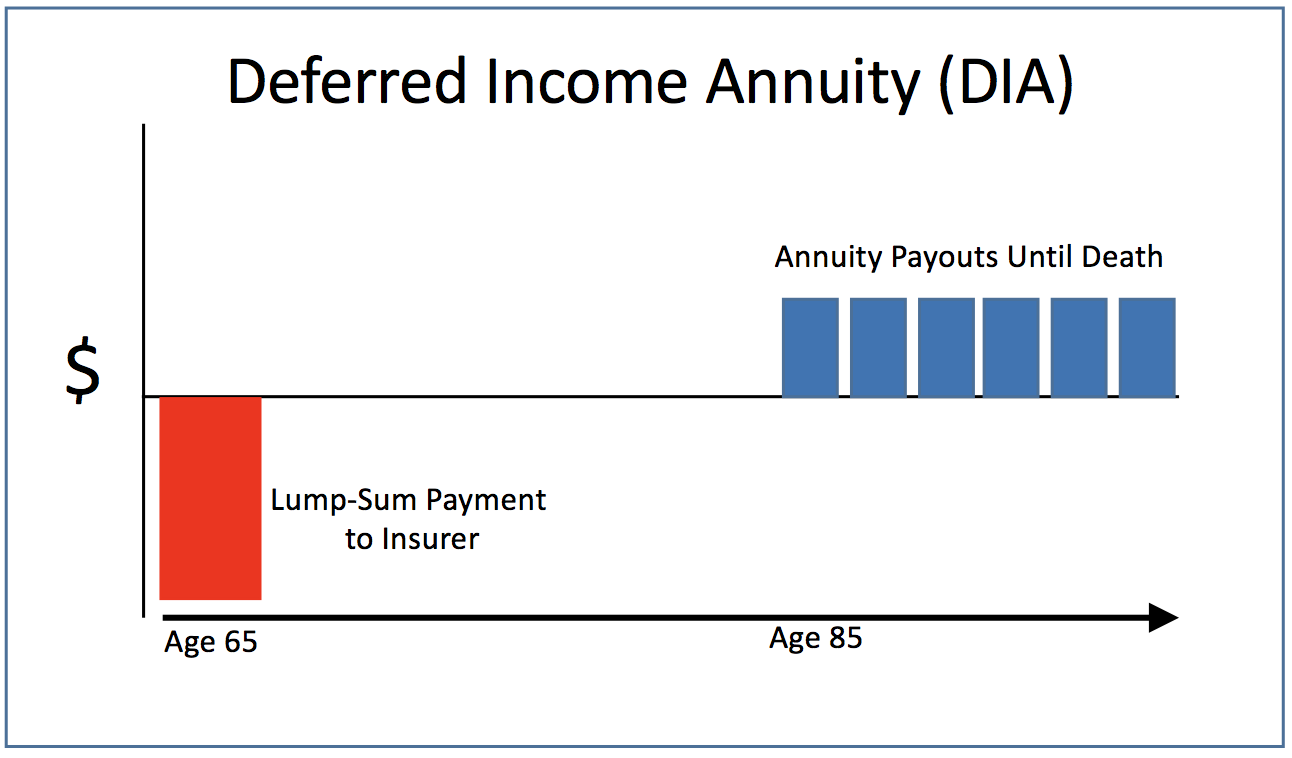

According to reports retirees with. Annuity consists of regular payments over a period of time whereas the flow of a lump sum is at a. SPIAs are commodities that need to be.

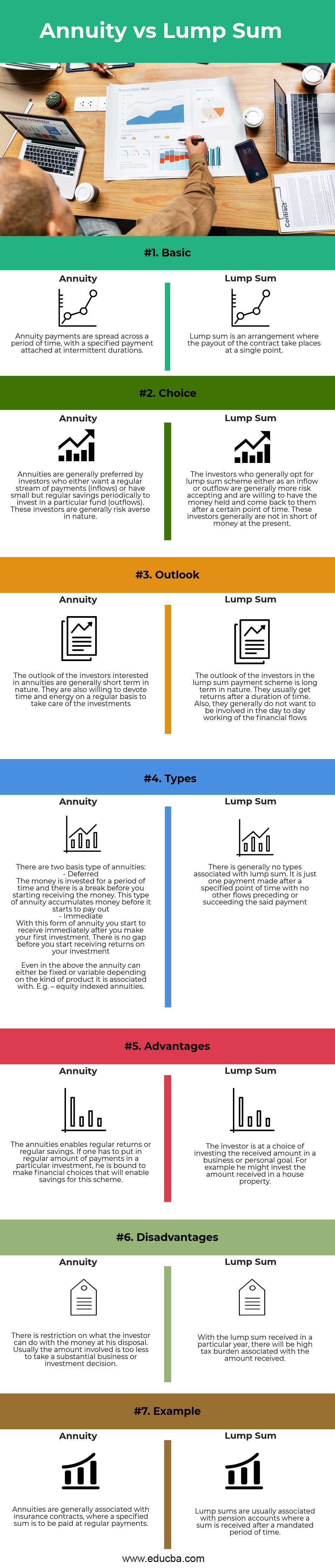

Ad A Calculator To Help You Decide How A Fixed Annuity Might Fit Into Your Retirement Plan. Annuity vs Lump Sum. The potential disadvantages of an annuity are exactly what can make a lump-sum payment appealing.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. PBGC pays lump sums only when a total benefit has a value of 5000 or less. A large cash payment now.

If you take the lump sum and expect to live another 18 years you have to. 11 Little-Know Tips You Must Know Before Buying. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life.

The savings interest rate that you designate is used to calculate present value for the annuity payment option and is. No Medical Exam - Simple Application. All other benefits are paid as a monthly annuity.

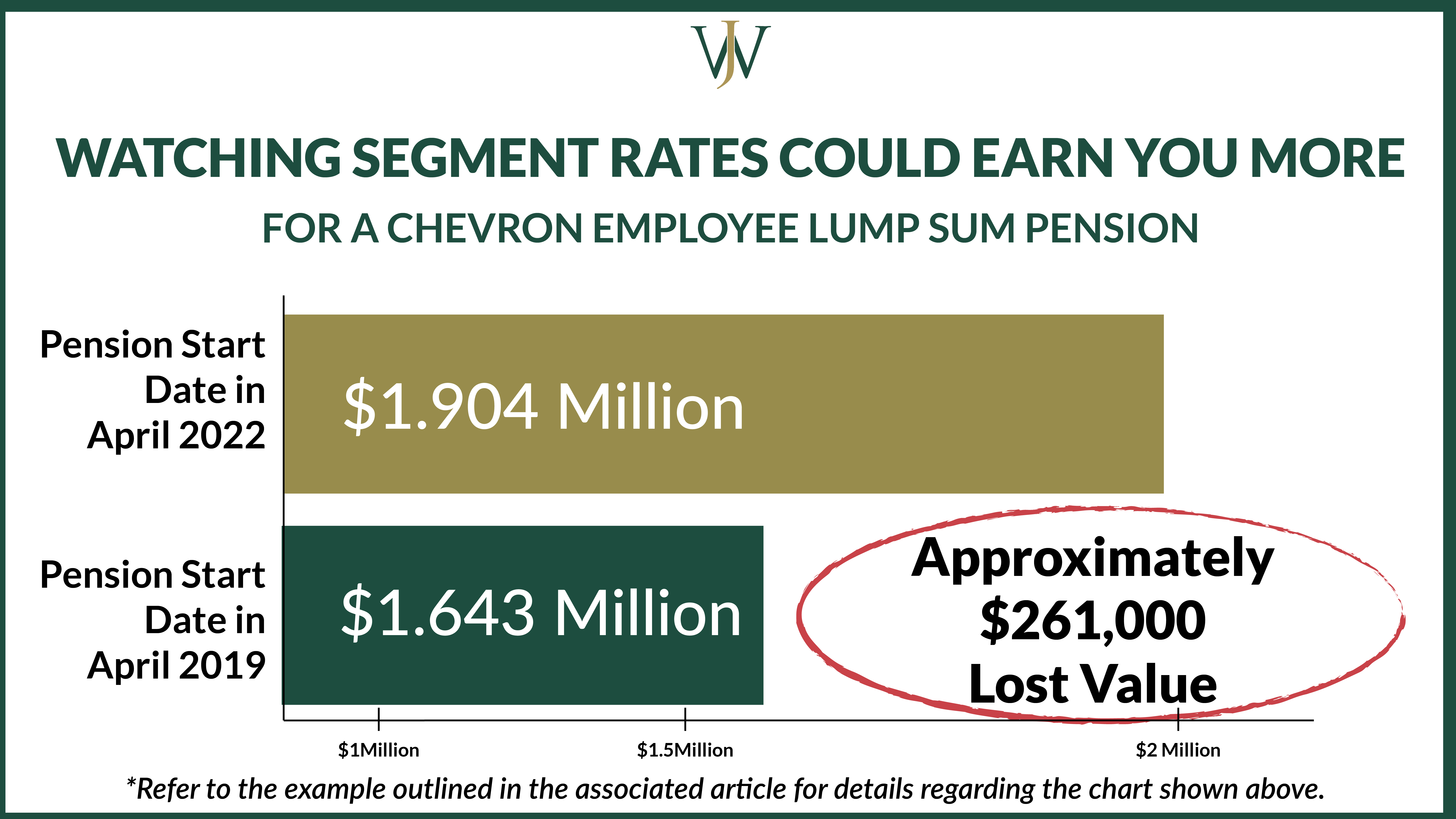

The main benefit though is the flexibility to invest the. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Generally the option with a higher present value is the better deal.

In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. After the date of your first payment you cannot.

Life annuity with 10 years certain. Your company gives you a choice of a 300000 lump sum or 2000 a month in a single-life annuity. With a lump sum your purchasing power will decrease as prices increase.

Ad Get this must-read guide if you are considering investing in annuities. If you take the 2500 per month then when you do. 100 joint and survivor annuity.

Its a single large sum of money that you receive all at once. 50 joint and survivor annuity. An annuity is a series of payments made at regular intervals over a certain.

A lump sum gives you capital to make large purchases or invest but your money can run. Dont Buy An Annuity Until You Review Our Top Picks For 2022. You can choose to receive your pension as a single lump sum or as regular annuity payments over time.

Your employer has also offered to pay you a lump sum of 300000 if you want to give up your monthly pension payments. Let us discuss some of the major differences between Annuity vs Lump Sum. The single life annuity is just one of many varieties of life annuities that can help fund retirement.

Single life annuity. Ad Get this must-read guide if you are considering investing in annuities. Of them all the single life annuity offers the.

The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected. Lottery winners can collect their prize as an annuity or as a lump-sum. Often referred to as a lottery annuity the annuity option provides annual payments over time.

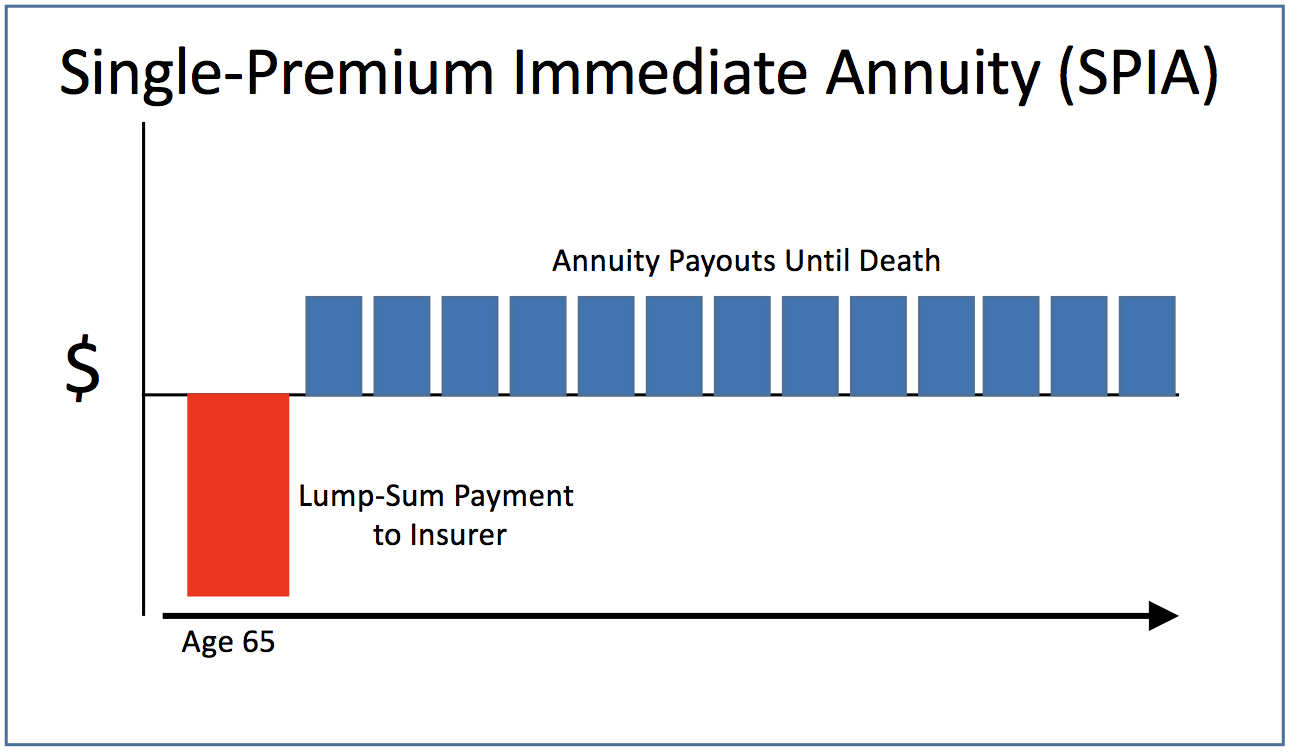

As Low As 349 Mo. A lump sum is a one-time payment. A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level.

What Is a Single Life Annuity. Learn More On AARP. Statistics show that sticking with an annuity is often the wisest move for a lot of Americans.

Annuity Vs Lump Sum Top 7 Useful Differences To Know

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Strategies To Maximize Pension Vs Lump Sum Decisions

Lottery Payout Options Annuity Vs Lump Sum

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Annuity Beneficiaries Inherited Annuities Death

Income Annuities Immediate And Deferred Seeking Alpha

Difference Between Annuity And Lump Sum Payment Infographics

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

Annuity Payout Options Immediate Vs Deferred Annuities

When Can You Cash Out An Annuity Getting Money From An Annuity

Lump Sum Payment Definition Finance Strategists

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Annuity Beneficiaries Inheriting An Annuity After Death

Difference Between Annuity And Lump Sum Payment Infographics

Should You Take The Annuity Or The Lump Sum If You Win The Lottery